After The Flood Comes The Million Dollar Question

THE MILLION DOLLAR QUESTION (POST HARVEY)

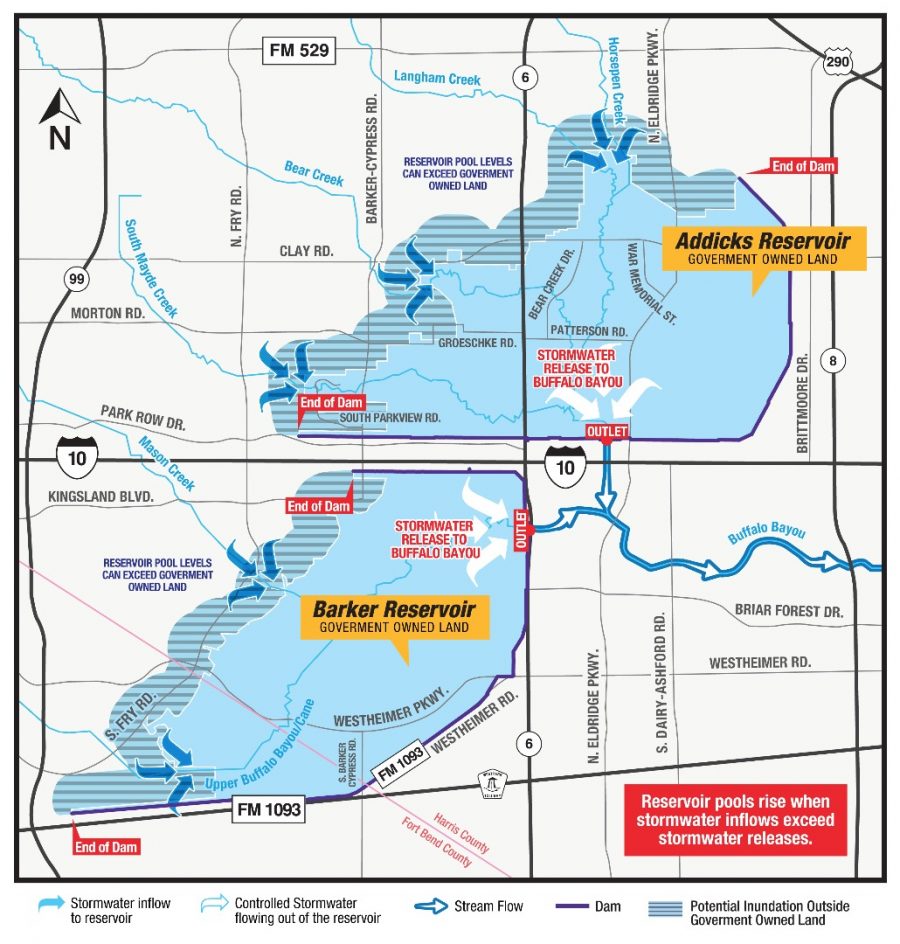

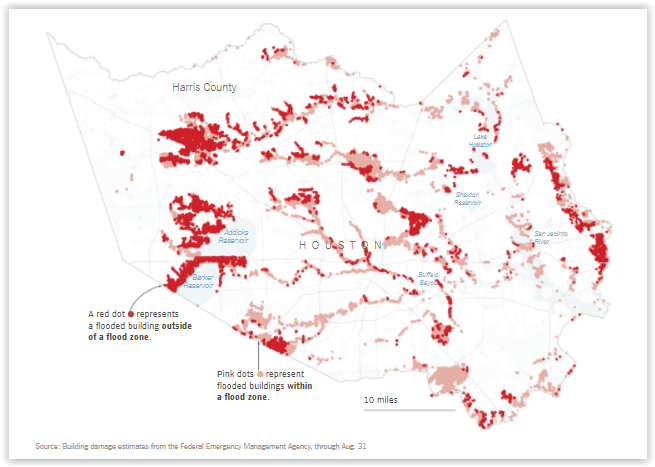

With the recovery from Hurricane Harvey comes a lot of uncertainty including “What will happen to home values now?”. And the only truthful answer at this point is “We don’t know yet”. According to the NY Times, over 40% of flooded homes were outside the FEMA designated flood zones in areas considered to be “of minimal flood hazard”(1). Since they were located in what is called Zone X, flood insurance was not required by lenders. Therefore, most home owners were not covered even though the federal flood program (NFIP) premiums can be very affordable if the home has never flooded.

Affected homes for the most part are not livable so occupants have either found accommodation with friends and family or are living in shelters, hotels or possibly FEMA provided temporary housing. A number of factors can affect the decision of the dislocated households to relocate, either temporarily or permanently, including availability of homes near existing schools and workplace. Renters may have been released from their lease obligations and are looking for other homes or apartments to rent or may possibly now be looking to buy. Since the flood has reduced available inventory of homes for sale and rent while the number of persons looking to rent/purchase has increased, this would logically indicate an increase in home prices. Of course, there are limitations not only due to anti price-gouging laws but also to cash and loan availability. There will certainly be temporary increases in rental pricing since it is able to react quicker to changes in supply and demand. Once the wave of relocation passes, which should take 3 months or so, rents should return closer to normal. It is what happens after this temporary resettlement that is more of an unknown. How will flooding affect not only individual home sale prices but also those in an individual subdivision or those closer to rivers, drainage and reservoirs? Will those homes in an area that flooded but did not flood themselves be affected? How will first time floods be impacted versus those that have chronic flooding? Only time will provide an answer to these questions.

The process to relocate homeowners is a longer and more involved process since they must not only have or locate financial resources to repair but also face decisions on whether to repair and stay or to move on. Many factors go into this decision, both emotional and financial. Most homes that flooded, whether 1-2” or 4-5 feet, will require the same process to renovate: 1) ‘muck out’ the floodwater soaked contents 2) gut the walls, cabinets and flooring 3) dry, clean, disinfect and 4) renovate. A huge outpouring of community assistance both locally and from around the country has helped with ‘mucking, gutting and drying’ but in most cases the renovation will require professional services, or in other words, available funds. Remember that most people also lost most of their possessions including furniture, clothing and vehicles in addition to their home. It will take time, assistance and money to replace these, as well.

There are several scenarios that homeowners and renters are dealing with as a result of flooding. They either 1) had flood insurance on the property 2) no NFIP but have sufficient equity in their home 3) no NFIP and little to no equity or 4) were renting.

Those in scenario 1 can typically recover with proceeds from flood insurance although they may have to come out of pocket to cover depreciation and deductibles. These homes will probably be the first to be completely renovated and moved back into. Homeowners with private flood insurance will have the fastest response and quickest recovery. However, the process will take time and is dependent on how fast the flood adjusters, insurers and mortgage companies can process the claims and proceeds. For the most part, the mortgage company controls the funds and will usually agree to an initial advance then as work is performed will issue the remaining funds. This requires more people in the process to verify work completion and issue payments, so it will take time.

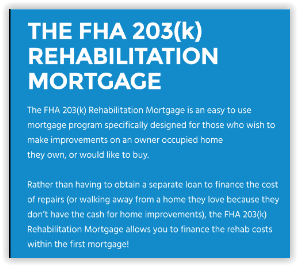

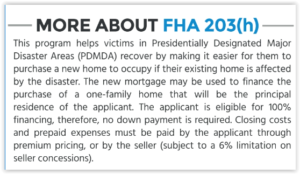

Homeowners without flood insurance may have to either use their own funds, which may not be sufficient

to complete the full renovation process, or borrow the required funds. While there are options available including FHA 203k and conventional ‘Homestyle’ renovation loans as well as FEMA/SBA loans, there will be cases where they do not qualify or just don’t otherwise have the ability to complete the financing. For displaced renters or homeowners whose homes were completely destroyed and must be rebuilt, they may qualify for a special FHA program (203h) available for purchasers that requires very little cash for them to close on a new home. This may be an opportunity for some renters to move up to home ownership and make it easier for some homeowners with limited cash to move on. However, this will be a limited number as most homes in the Houston area were not completely destroyed, so this option will be more useful for renters or those in the direct storm impact area like Port Aransas.

to complete the full renovation process, or borrow the required funds. While there are options available including FHA 203k and conventional ‘Homestyle’ renovation loans as well as FEMA/SBA loans, there will be cases where they do not qualify or just don’t otherwise have the ability to complete the financing. For displaced renters or homeowners whose homes were completely destroyed and must be rebuilt, they may qualify for a special FHA program (203h) available for purchasers that requires very little cash for them to close on a new home. This may be an opportunity for some renters to move up to home ownership and make it easier for some homeowners with limited cash to move on. However, this will be a limited number as most homes in the Houston area were not completely destroyed, so this option will be more useful for renters or those in the direct storm impact area like Port Aransas.

Owners without flood insurance will ultimately have to make an economic decision to make based on how much repairs will cost and resale value of their home. It will come down to factors such as: equity in the home (or put differently, remaining loan balance), availability of cash and credit history among others. These can be determined with relative ease. The simple equation is a) loan balance plus b) repairs and c) other temporary living costs versus the expected resale value of the home after repairs (ARV). Essentially, they will need to evaluate the value to them of staying in the existing home against the potential financial risk and/or impact on credit of the decision to repair or walk away. There may be emotional reasons to stay or leave the home, as well as proximity to schools, work, friends etc. There is also a potential for damage to credit history that can last for years if they decide to just mail the keys back to the mortgage company.

This uncertainty increases when they plug the resale value of their home into the equation. For now it is too early to know or even reasonably estimate the impact on home values due to flooding. This is very dependent on location (think proximity to flood zones/prone areas) and history of flooding (one time flood versus regular flooding events) and even disparity in impact within a neighborhood. There can be a stigma attached to living in an area that has experienced flooding even if the home itself did not. The impact of potential future foreclosures adds another level of uncertainty to determining future sales value.

Several options will likely arise based on equity in the home including:

- repair and stay after refinancing, although their total home cost may be higher than resale value

- repair and sell/rent, most likely if they have sufficient equity and resources

- sell ‘as-is’ to an investor if owned outright or with the intent to repay mortgage (possibly via short sale)

- let lender foreclose

- possibly even perform minimal repairs and continue to live in the home, hoping to rebuild some time in the future.

With option 1, they will have maintained their existing home possibly without even increasing their monthly payment, although the disaster would have impaired equity they had built over time. Option 2 could result in the purchase a new home and although their financial position has been impaired, they are able move on and recover. Option 3 may or may not be possible as most investors will be looking to pay from 30-50% of pre-disaster value for the home. Option 4 is most likely if they have little equity, insufficient cash and potentially a less than optimal credit score. These people could possibly finance a new home before foreclosure but more than likely will become renters again. Unfortunately, option 5 is not recommended due to the severe health implications of mold and flood water infested quarters. Hopefully other resources will become available for the less fortunate as the depth of the disaster gets addressed by local and federal government entities. There is discussion of FEMA buy-outs for flood prone homes but these are typically based on habitual flood areas and not for ‘one-time floods’ and take significant time to come to fruition.

What next?

For now, all realtors can do is to advise their clients to make sure to 1) file a claim with homeowner’s and flood insurance providers 2) register with FEMA to ensure access to all the assistance programs including SBA loans 3) select reputable contractors to pro vide realistic estimates for repairs 4) contact preferred lending partners to evaluate specific programs available and most importantly, 5) make decisions based on facts, not emotion. We can help by providing with information on available resources, both public and private, referrals to trusted partners and to keep you updated with current market data as it becomes available. We can also prepare a market analysis based on historic home sales, but ultimately the market will determine the price.

vide realistic estimates for repairs 4) contact preferred lending partners to evaluate specific programs available and most importantly, 5) make decisions based on facts, not emotion. We can help by providing with information on available resources, both public and private, referrals to trusted partners and to keep you updated with current market data as it becomes available. We can also prepare a market analysis based on historic home sales, but ultimately the market will determine the price.

Therefore, “What is my home worth?” is the million dollar question that we don’t have an answer for yet. We can only continue to serve our friends, family and clients by providing the best information, partners and support possible.

To receive YOUR customized market analysis, please contact us at 832-248-4776 or submit an email request and we will create a custom market analysis for you.